What is a "check list de facturas"?

A "check list de facturas" is a checklist of invoices. It is used to track the status of invoices, such as whether they have been sent, received, or paid. A check list de facturas can also be used to track the amount of money that is owed on each invoice.

Checklists de facturas are important because they help businesses to keep track of their finances and to avoid losing money. They can also help businesses to improve their cash flow by ensuring that invoices are paid on time.

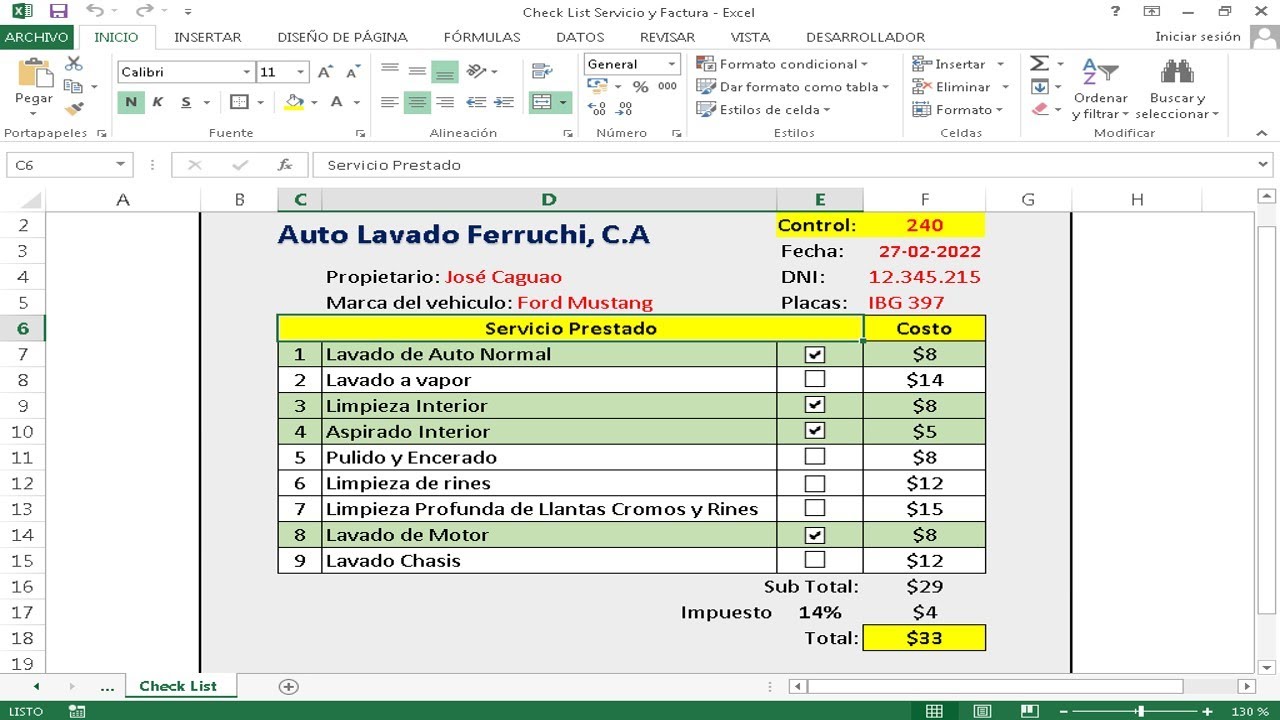

There are many different ways to create a check list de facturas. Some businesses use a simple spreadsheet, while others use more sophisticated software. The best method for creating a check list de facturas will vary depending on the size of the business and the number of invoices that are processed each month.

check list de facturas

Key Aspects

- Keep track of the status of invoices

- Avoid losing money

- Improve cash flow

{point}

- Use a simple spreadsheet or more sophisticated software

- Customize the check list de facturas to fit the needs of the business

- Review the check list de facturas regularly and update it as needed

{point}

- Improved financial management

- Reduced risk of losing money

- Improved cash flow

{point}

- Can be time-consuming to create and maintain

- May not be effective if not used consistently

- Can be difficult to track invoices if they are not entered into the check list de facturas promptly

check list de facturas

A check list de facturas, or invoice checklist, is a crucial tool for businesses to manage their finances effectively. It helps track the status of invoices, ensuring timely payments and reducing the risk of lost revenue. Here are five key aspects of check list de facturas:

- Tracking Invoice Status: Monitor the progress of invoices from issuance to payment, ensuring no invoice falls through the cracks.

- Preventing Revenue Loss: Identify unpaid or overdue invoices promptly, minimizing the risk of bad debts and maximizing cash flow.

- Enhancing Cash Flow: By tracking invoice payments, businesses can forecast cash flow more accurately and plan for future expenses.

- Improving Customer Relationships: Regular follow-up on invoices demonstrates professionalism and fosters positive customer relationships.

- Optimizing Business Processes: Check list de facturas helps identify bottlenecks and inefficiencies in the invoicing process, allowing for continuous improvement.

In conclusion, check list de facturas are essential for businesses to maintain financial control, optimize cash flow, and enhance customer relationships. By implementing a robust invoice checklist system, businesses can streamline their invoicing processes, minimize revenue loss, and gain valuable insights into their financial performance.

Tracking Invoice Status

Tracking invoice status is a critical aspect of check list de facturas, as it allows businesses to maintain visibility and control over their accounts receivable. By monitoring the progress of invoices from the moment they are issued until they are paid, businesses can ensure that no invoice is overlooked or forgotten, minimizing the risk of lost revenue.

- Timely Follow-Ups: Check list de facturas enables businesses to track the aging of invoices, identifying those that are overdue or approaching their due date. This allows for timely follow-ups with customers, increasing the likelihood of prompt payment.

- Reduced Disputes: By maintaining accurate records of invoice status, businesses can quickly address any discrepancies or disputes that may arise. This reduces the risk of payment delays or disputes escalating into larger issues.

- Improved Cash Flow Forecasting: Tracking invoice status provides businesses with a clear understanding of their outstanding receivables. This information is essential for accurate cash flow forecasting, allowing businesses to plan for future expenses and investments.

- Enhanced Customer Relationships: Regular follow-ups on invoice status demonstrate to customers that their business is valued. This fosters positive relationships and encourages timely payments.

In summary, tracking invoice status through check list de facturas empowers businesses to maintain control over their accounts receivable, minimize revenue loss, and enhance customer relationships. By ensuring that every invoice is tracked and followed up on diligently, businesses can optimize their cash flow and financial performance.

Preventing Revenue Loss

In the context of check list de facturas, preventing revenue loss is paramount. Unpaid or overdue invoices can significantly impact a business's financial health, leading to bad debts and reduced cash flow. A check list de facturas plays a crucial role in identifying these invoices promptly, enabling businesses to take proactive measures to minimize losses.

- Early Detection and Follow-Up: Check list de facturas allows businesses to track invoice status, identifying unpaid or overdue invoices at an early stage. This enables timely follow-ups with customers, increasing the likelihood of prompt payment and reducing the risk of bad debts.

- Aging Analysis: By analyzing the aging of invoices, businesses can prioritize their collection efforts. Check list de facturas provides insights into which invoices are most at risk of becoming uncollectible, allowing businesses to focus their resources on recovering these amounts.

- Dispute Resolution: Check list de facturas helps businesses maintain a clear record of invoice status and communication with customers. This facilitates the resolution of disputes or discrepancies, preventing them from escalating into larger issues that could impact revenue.

- Improved Cash Flow Management: By identifying unpaid or overdue invoices promptly, businesses can take steps to improve their cash flow. This includes negotiating payment plans, offering discounts for early payment, or considering legal action if necessary.

In summary, check list de facturas is a powerful tool for preventing revenue loss by enabling businesses to identify unpaid or overdue invoices promptly. Through early detection, aging analysis, dispute resolution, and improved cash flow management, businesses can minimize the risk of bad debts and maximize their revenue.

Enhancing Cash Flow

Within the realm of check list de facturas, enhancing cash flow is a critical objective. Tracking invoice payments is a fundamental aspect of achieving this goal, as it provides businesses with essential insights into their financial performance.

- Accurate Cash Flow Forecasting: Check list de facturas enables businesses to monitor the status of invoices, including payments received and outstanding balances. This information is invaluable for forecasting cash flow, as it allows businesses to predict future cash inflows and outflows with greater accuracy.

- Informed Decision-Making: With accurate cash flow forecasts, businesses can make well-informed decisions regarding their financial operations. This includes planning for upcoming expenses, such as inventory purchases, equipment investments, or staff salaries, ensuring that the business has sufficient funds to meet its obligations.

- Improved Financial Stability: By tracking invoice payments and forecasting cash flow, businesses can maintain financial stability. They can avoid cash shortfalls and ensure that they have the resources to cover necessary expenses, such as rent, utilities, and payroll.

- Increased Profitability: Improved cash flow management can enhance a business's profitability. By optimizing the timing of payments and collections, businesses can reduce their reliance on external financing, minimizing interest expenses and improving their bottom line.

In conclusion, check list de facturas plays a crucial role in enhancing cash flow for businesses. Through accurate cash flow forecasting, informed decision-making, improved financial stability, and increased profitability, businesses can strengthen their financial position and achieve long-term success.

Improving Customer Relationships

Within the realm of check list de facturas, improving customer relationships is of paramount importance. Regular follow-up on invoices not only ensures timely payments but also demonstrates professionalism and fosters positive customer interactions.

- Professionalism and Trust: Regular follow-up on invoices conveys a sense of professionalism and attention to detail, which can build trust with customers. It shows that the business values their relationship and is committed to providing excellent service.

- Communication and Transparency: Check list de facturas facilitates clear and timely communication with customers regarding their invoices. This transparency strengthens the customer relationship by fostering a sense of understanding and reducing misunderstandings.

- Issue Resolution: Regular follow-up provides opportunities to address any issues or discrepancies related to invoices promptly. By resolving these issues efficiently, businesses demonstrate their commitment to customer satisfaction and maintain positive relationships.

- Customer Retention: Positive customer relationships fostered through effective invoice management can lead to increased customer retention. Satisfied customers are more likely to continue doing business with companies that value their patronage and provide exceptional service.

In conclusion, check list de facturas plays a vital role in improving customer relationships by promoting professionalism, communication, issue resolution, and customer retention. By implementing a robust check list de facturas system, businesses can enhance their customer interactions, foster loyalty, and drive long-term success.

Optimizing Business Processes

Check list de facturas plays a vital role in optimizing business processes by identifying areas for improvement in the invoicing process.

- Identifying Bottlenecks: Check list de facturas helps businesses pinpoint specific steps or tasks in the invoicing process that are causing delays or inefficiencies. By analyzing invoice status and tracking the time taken for each step, businesses can identify bottlenecks and take measures to streamline the process.

- Eliminating Redundancies: Check list de facturas enables businesses to identify duplicate or unnecessary steps in the invoicing process. By eliminating redundancies, businesses can simplify the process, reduce errors, and improve efficiency.

- Improving Communication: Check list de facturas facilitates better communication between different departments involved in the invoicing process, such as sales, accounting, and customer service. By establishing clear roles and responsibilities, businesses can minimize confusion and ensure that invoices are processed smoothly.

- Standardizing Procedures: Check list de facturas helps businesses standardize invoicing procedures, ensuring consistency and accuracy throughout the process. By documenting and implementing standardized procedures, businesses can reduce errors, improve compliance, and enhance overall efficiency.

In summary, check list de facturas is an invaluable tool for optimizing business processes related to invoicing. By identifying bottlenecks, eliminating redundancies, improving communication, and standardizing procedures, businesses can streamline their invoicing process, enhance efficiency, and drive continuous improvement.

FAQs on Check List de Facturas

This section addresses frequently asked questions (FAQs) regarding check list de facturas, providing clear and concise answers to common concerns and misconceptions.

Question 1: What are the key benefits of using a check list de facturas?

Answer: Check list de facturas offers numerous benefits, including improved invoice tracking, reduced revenue loss, enhanced cash flow, stronger customer relationships, and optimized business processes. By implementing a robust check list de facturas system, businesses can gain greater control over their accounts receivable, minimize financial risks, and streamline their invoicing operations.

Question 2: How can check list de facturas help businesses prevent revenue loss?

Answer: Check list de facturas plays a crucial role in preventing revenue loss by enabling businesses to identify unpaid or overdue invoices promptly. Through regular follow-ups, aging analysis, and effective dispute resolution, businesses can minimize the risk of bad debts and maximize their revenue. A well-maintained check list de facturas ensures that all invoices are tracked and addressed diligently, reducing the likelihood of lost revenue due to overlooked or forgotten invoices.

In summary, check list de facturas is an essential tool for businesses seeking to improve their financial management, optimize cash flow, and enhance customer relationships. By addressing common concerns and highlighting the key benefits of using a check list de facturas, this FAQ section provides valuable insights into this important aspect of accounts receivable management.

Conclusin sobre "check list de facturas"

En conclusin, la "check list de facturas" es una herramienta indispensable para las empresas que buscan mejorar su gestin financiera, optimizar su flujo de caja y fortalecer sus relaciones con los clientes. A lo largo de este artculo, hemos explorado los aspectos clave de las "check list de facturas", destacando sus beneficios, funcionalidades y papel crucial en la gestin de las cuentas por cobrar.

La implementacin de un sistema slido de "check list de facturas" permite a las empresas realizar un seguimiento eficaz de las facturas, minimizar las prdidas de ingresos, mejorar el flujo de caja y optimizar los procesos comerciales relacionados con la facturacin. Al abordar inquietudes comunes y resaltar los beneficios clave del uso de una "check list de facturas", este artculo proporciona informacin valiosa sobre este aspecto esencial de la gestin de cuentas por cobrar.

You Might Also Like

Rediscover The Charm: Bobby Morris Playfield In The Heart Of Seattle2023's Guide To The Electrifying Rock And Roll Sushi Experience

Sub Zero Simi Valley: Your Local Cooling Experts

- Steph Curry's Age: The Golden State Warriors Star In 2014 -

Elevate Your Experience: Indulge In The Flavors Of Big Mom's Finest

Article Recommendations